If your bank account is frozen, to unfreeze the account, the bank manager will ask you to submit a request letter/application. Until you unfreeze your bank account you cannot withdraw funds using debit cards, cheques, UPI, and through internet banking,

Here you can find some of the best bank account unfreeze letter formats that you can submit to your bank manager. You can use any of the below formats that suit your requirements.

We will also guide you with FAQs and formatting tips to craft an effective “ application to unfreeze bank account”.

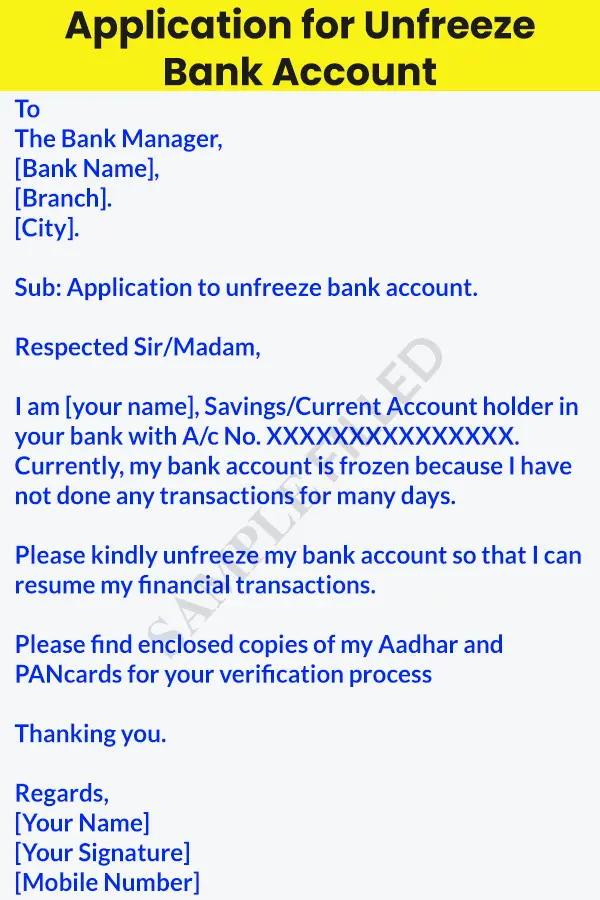

Application for Unfreeze Bank Account

To

The Bank Manager,

[Bank Name],

[Branch].

[City].

Sub: Application to unfreeze bank account.

Respected Sir/Madam,

I am [your name], Savings/Current Account holder in your bank with A/c No. XXXXXXXXXXXXXXX. Currently, my bank account is frozen because I have not done any transactions for many days.

Please kindly unfreeze my bank account so that I can resume my financial transactions.

Please find enclosed copies of my Aadhar and PANcards for your verification process

Thanking you.

Regards,

[Your Name]

[Your Signature]

[Mobile Number]

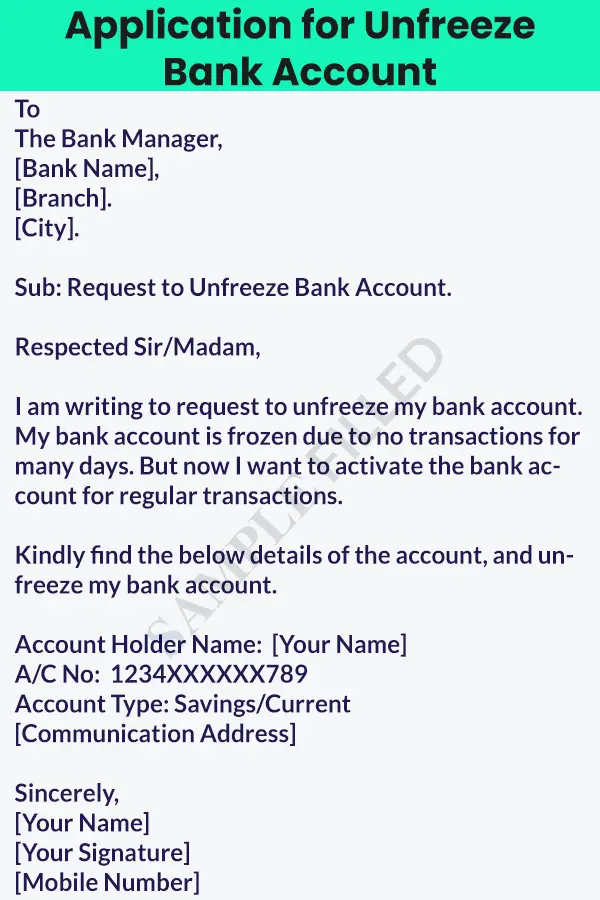

Simple Account Unfreeze Application

To

The Bank Manager,

[Bank Name],

[Branch].

[City].

Sub: Request to Unfreeze Bank Account.

Respected Sir/Madam,

I am writing to request to unfreeze my bank account. My bank account is frozen due to no transactions for many days. But now I want to activate the bank account for regular transactions.

Kindly find the below details of the account, and unfreeze my bank account.

Account Holder Name: [Your Name]

A/C No: 1234XXXXXX789

Account Type: Savings/Current

[Communication Address]

Sincerely,

[Your Name]

[Your Signature]

[Mobile Number]

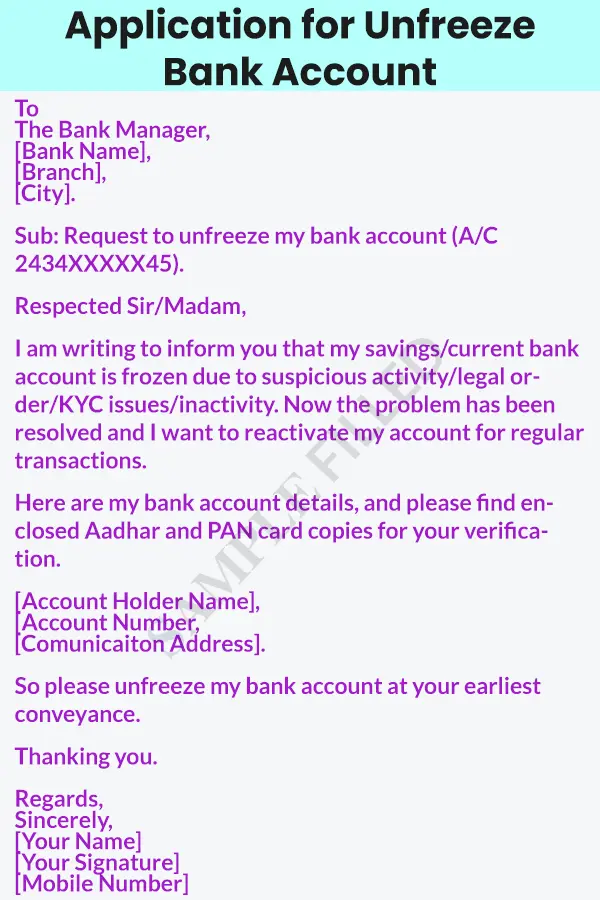

Unfreeze Bank Account Letter to Manager

To

The Bank Manager,

[Bank Name],

[Branch],

[City].

Sub: Request to unfreeze my bank account (A/C 2434XXXXX45).

Respected Sir/Madam,

I am writing to inform you that my savings/current bank account is frozen due to suspicious activity/legal order/KYC issues/inactivity. Now the problem has been resolved and I want to reactivate my account for regular transactions.

Here are my bank account details, and please find enclosed Aadhar and PAN card copies for your verification.

[Account Holder Name],

[Account Number,

[Comunicaiton Address].

So please unfreeze my bank account at your earliest conveyance.

Thanking you.

Regards,

Sincerely,

[Your Name]

[Your Signature]

[Mobile Number]

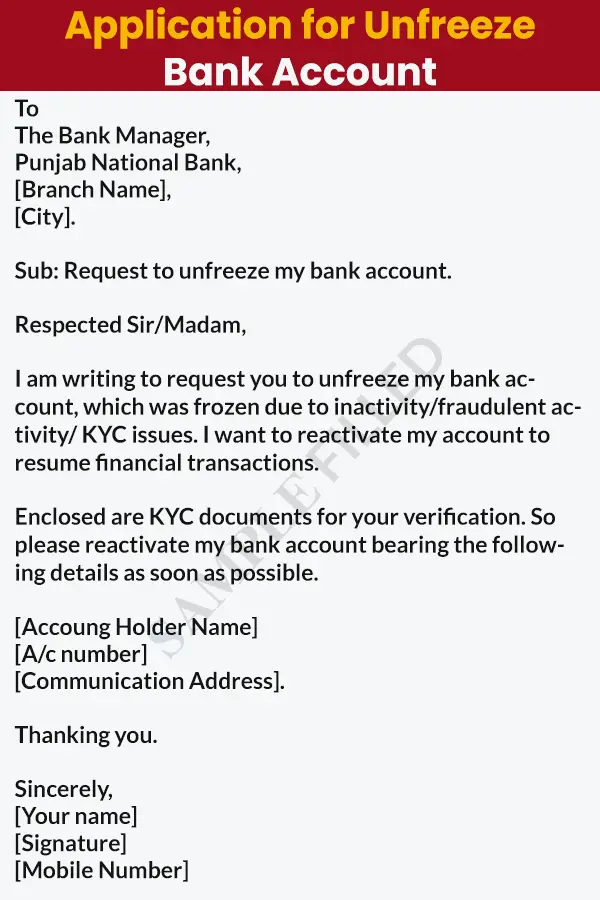

PNB Account Unfreeze Application

To

The Bank Manager,

Punjab National Bank,

[Branch Name],

[City].

Sub: Request to unfreeze my bank account.

Respected Sir/Madam,

I am writing to request you to unfreeze my bank account, which was frozen due to inactivity/fraudulent activity/ KYC issues. I want to reactivate my account to resume financial transactions.

Enclosed are KYC documents for your verification. So please reactivate my bank account bearing the following details as soon as possible.

[Accoung Holder Name]

[A/c number]

[Communication Address].

Thanking you.

Sincerely,

[Your name]

[Signature]

[Mobile Number]

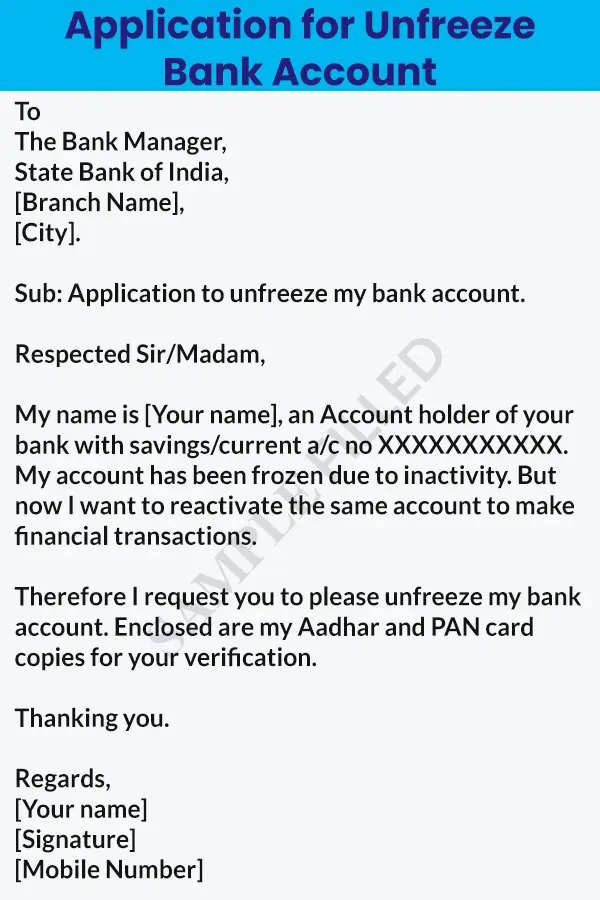

SBI Account Unfreeze Application

To

The Bank Manager,

State Bank of India,

[Branch Name],

[City].

Sub: Application to unfreeze my bank account.

Respected Sir/Madam,

My name is [Your name], an Account holder of your bank with savings/current a/c no XXXXXXXXXXX. My account has been frozen due to inactivity. But now I want to reactivate the same account to make financial transactions.

Therefore I request you to please unfreeze my bank account. Enclosed are my Aadhar and PAN card copies for your verification.

Thanking you.

Regards,

[Your name]

[Signature]

[Mobile Number]

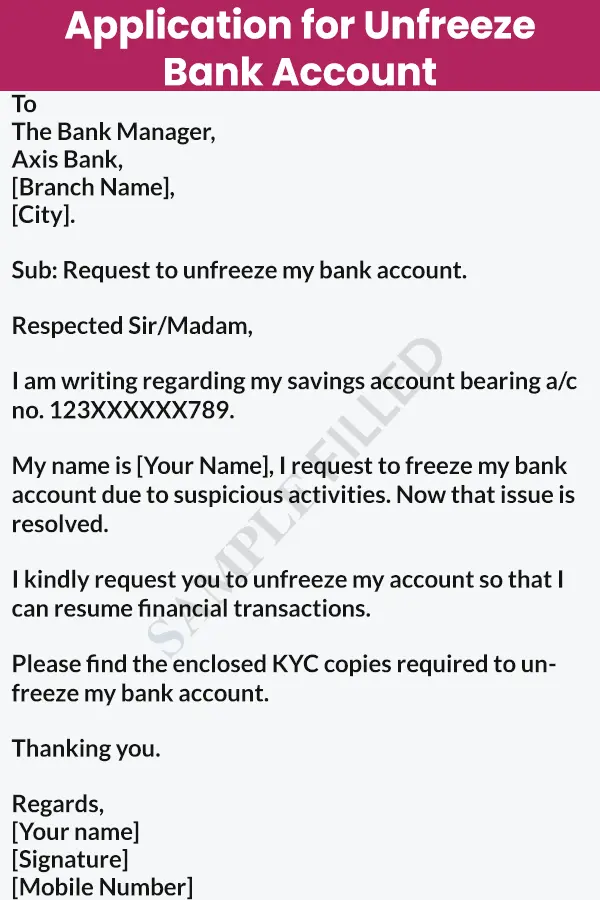

Axis Bank Account Unfreeze Application

To

The Bank Manager,

Axis Bank,

[Branch Name],

[City].

Sub: Request to unfreeze my bank account.

Respected Sir/Madam,

I am writing regarding my savings account bearing a/c no. 123XXXXXX789.

My name is [Your Name], I request to freeze my bank account due to suspicious activities. Now that issue is resolved.

I kindly request you to unfreeze my account so that I can resume financial transactions.

Please find the enclosed KYC copies required to unfreeze my bank account.

Thanking you.

Regards,

[Your name]

[Signature]

[Mobile Number]

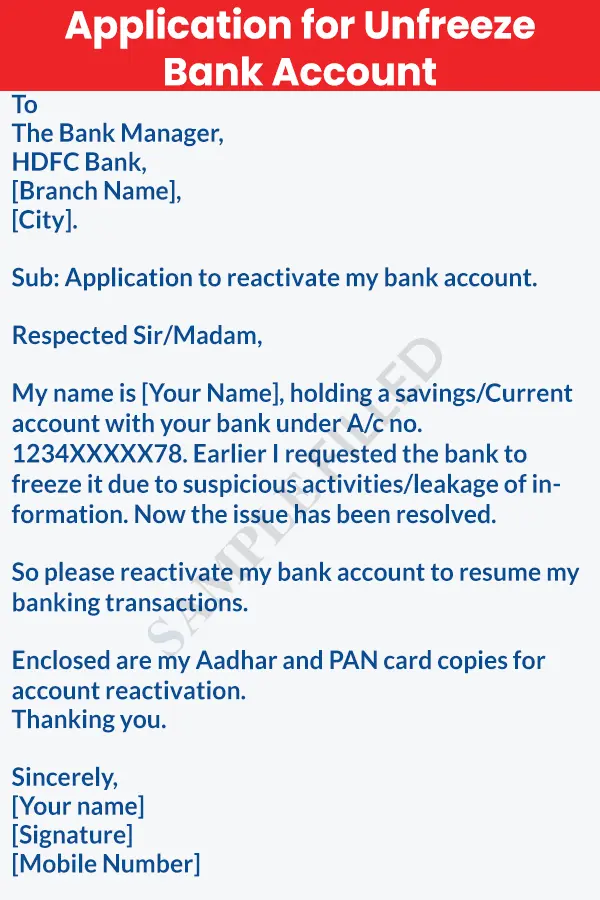

HDFC Account Unfreeze Application

To

The Bank Manager,

HDFC Bank,

[Branch Name],

[City].

Sub: Application to reactivate my bank account.

Respected Sir/Madam,

My name is [Your Name], holding a savings/Current account with your bank under A/c no. 1234XXXXX78. Earlier I requested the bank to freeze it due to suspicious activities/leakage of information. Now the issue has been resolved.

So please reactivate my bank account to resume my banking transactions.

Enclosed are my Aadhar and PAN card copies for account reactivation.

Thanking you.

Sincerely,

[Your name]

[Signature]

[Mobile Number]

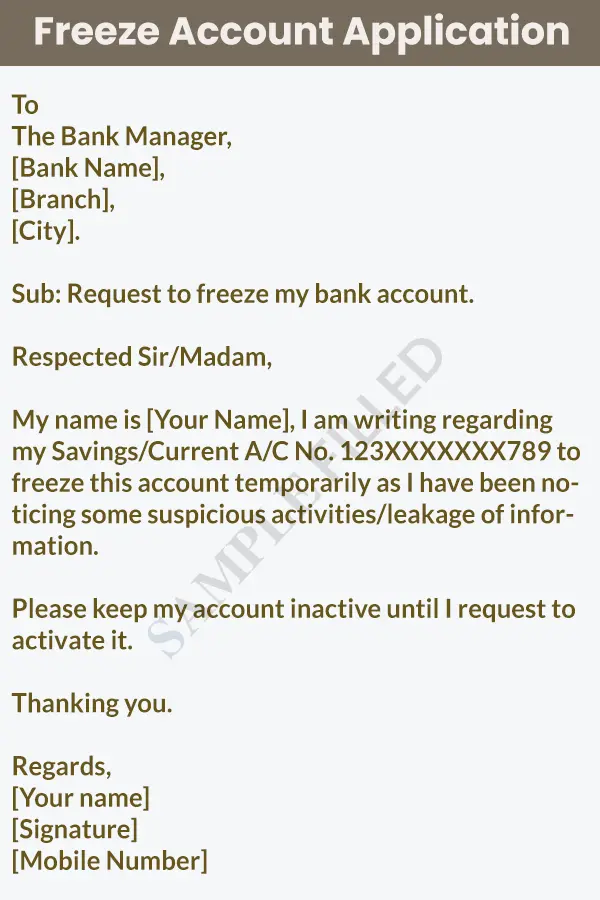

Freeze Account Application

To

The Bank Manager,

[Bank Name],

[Branch],

[City].

Sub: Request to freeze my bank account.

Respected Sir/Madam,

My name is [Your Name], I am writing regarding my Savings/Current A/C No. 123XXXXXXX789 to freeze this account temporarily as I have been noticing some suspicious activities/leakage of information.

Please keep my account inactive until I request to activate it.

Thanking you.

Regards,

[Your name]

[Signature]

[Mobile Number]

Components of a Good “Unfreeze Bank Account Application”

1. Recipient: Address the letter to the Bank manager, and include details like bank name, branch, and city.

2. Subject: use a simple subject line. Ex: Application to unfreeze my bank account (or) Request to unfreeze my bank account.

3. Salutation: Begin the letter with “Respected Sir/Madam”.

4. Introduction: Mention the purpose of the letter. Specify your identity as a Savings/Current account holder with the bank and also mention your Account number.

5. Explanation: Describe the reason for the account freeze such as inactivity/suspicious activities/fraudulent activities/ KYC issues etc.

6. Request: Request the bank manager to unfreeze the bank account so that you can resume your financial transactions.

7. Enclosures: Mention that you have enclosed required document copies such as Aadhar and PAN card for verification.

8. Thanking & Closure: Thank the bank manager for considering the request and close the letter with:

Regards,

[Your Name]

[Signture]

[Mobile Number]

Tips to Write an Effective “Unfreeze Bank Account Application”

1. Clear & Concise Subject Line: Use a clear and short subject line that informs the recipient about the purpose of the letter immediately.

2. Polite & Respectful Tone: Begin the letter with a courteous salutation “Respected Sir/Madam”, which shows politeness and respect towards the recipient.

3. Brief and to the Point: Clearly state the account holder’s name, account type, account number, and reason for the account being frozen.

4. Specific Request: Request the bank manager to unfreeze your bank account to resume your financial transactions.

5. Enclosure of Required Documents: Mention that you have enclosed copies of your Aadhar and PAN card to make the verification process smoother.

FAQs

It takes 7-10 days, but the final duration depends on the bank’s policies and the reason for the freeze.

You receive notifications from the bank, and you will face problems in making financial transactions and accessing funds.

You should contact your bank directly and provide the required information and documentation to unfreeze your bank account.

There are several reasons to block a bank account inactivity/ suspicious activities/fraudulent activities/KYC issues/ court orders etc..

When a bank account remains inactive for a long period without any transactions or activity then it will become a dormant bank account. It levies fees and restrictions on using the account.

A frozen bank account can receive the money, but you can’t withdraw or transfer money.

You can withdraw or transfer the money only after unfreezing the account by the bank officials. For that, you have to resolve the issues causing the account freeze.

Yes, you can open a new bank account in the new bank, however, you will face difficulties if you want to open a new account in the same bank until you resolve the freezing issue.

Yes, banks can freeze your account for KYC (Know Your Customer) compliance reasons, such as not submitting Aadhar, PAN and identity details, etc.

It depends on the freezing reason. If you temporarily freeze your account then you can request the bank’s customer care to activate it. If the bank itself freezes your account then you have to visit the bank to activate it.

Recommended: