Form 12B is required when an employee joins in a new organization. An employee needs to submit this form to the new employer as per rule 26A. Based on the information furnished in form 12b new employer will calculate tax deduction of the employee for that particular financial year. But submitting form 12B is not mandatory. Here you can know complete details on how to fill form 12B and you can also find sample filled form 12B.

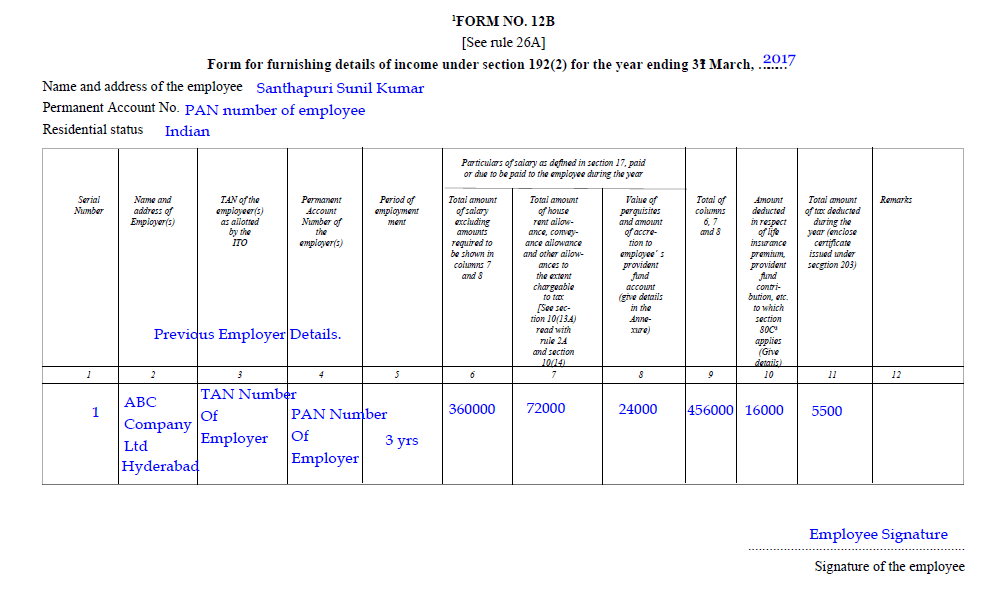

How To Fill Form 12B Or Sample Filled Form 12B

Form 12b consists three pages. Here employee needs to write details like name of the previous employer, TAN number of the previous employer, employee name and his PAN number, house rent allowances, provident fund details and income tax deductions under sections 80C, 80G, 80D, 80E and Section 24.

Sample Filled Form 12B

As we discussed earlier submission of form 12B is not mandatory. But it is a good practice when an individual submits form 12B when he changes his or her job in the middle of the year, it makes easy to your new employer to assess your income tax deduction for that particular financial year. So finally it is the complete responsibility of the employee to submit form 12 B to the new employer. Employees can find their deducted income tax details in form 16 which they will get it from their employer.

You may also like: How to fill RTO Form 29

Do share your opinions and doubts on how to fill form 12B and sample filled form 12B.

Very informative article. Thanks for sharing all the information about Filling Form 12B. I was looking for some information regarding this and the article was a great help to me.

What is the amount to be mentioned in the HRA allowance section? The amount that we get as HRA from the company or the amount exempted from tax?

@ Mitul Jain,

HRA allowances vary from company to company, you can find it in your appointment letter or pay slip. House Rent Allowances are tax exempted.

Hi

How to handle exemptions like leave encashment and Gratuity income on form 12b.

Were you able to find the answer to your question. “How to handle exemptions like leave encashment and Gratuity income on form 12b”

Hi,

I have a query regarding 12b form. On the top which tear we have to mention like 2019 or 2020.

Hi, I have joined new company on may 3 2021 and my new employer is asking form 12B. Should i fill form 12B with the previous income details from april 1st to last working day in previous company or should i fill it for the whole previous financial year of 2020-2021 please help

Could you please elaborate more on how to fill columns 6,7and 8 on the first page of form 12B?

Ya. Can someone help us with this info?

I tried to searching past 2 hour to find nothing.

Especially in column 7 what exactly allowance mean? Are those allowances referring to which we are claiming? Or just available in salary component