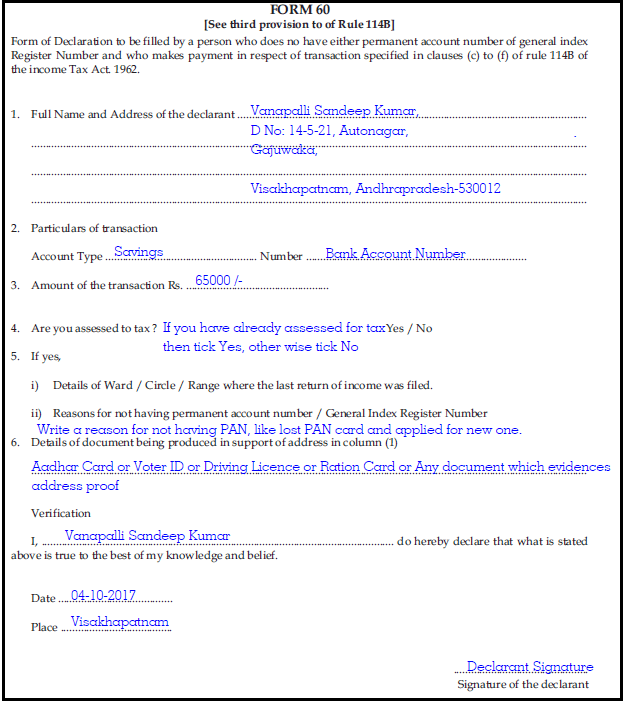

Form no 16 is a form for declaration to be filled by an individual or person who doesn’t have PAN ( Permanent Account Number) and who enters into any transaction specified in rule 114 B. As we all know PAN card is required to make various financial transactions. But in some cases, individuals may not have their PAN card, in those cases individuals need to submit form 60 instead of PAN card. Here you can find sample filled form 60 and you can also learn how to fill form 60.

Sample Filled Form 60 | How To Fill Form 60As

Also Read: How To Fill Form 12B

On Form 60 individuals need to mention:

1. Full name and address

2. Bank account type and account number

3. Amount of transaction for which you are filling form 60.

4. If you are already assessed under income tax then mention those details.

5. Write reason for not having Permanent Account Number. For an example: Lost PAN card and applied for renewal.

6. Write details of the document which you are submitting as an address proof, which may be Aadhar card or voter id or ration card or driving licence or any document which evidences address proof of the individual.

Do share your opinions and doubts on sample filled form 60 or how to fill form 60 in below comments section.

i want to know how to submit online form-35 and taken print out for issuance n.o.c.